7 Ways to Grow Your Net Worth Today

There are many ways to grow your net worth today and in this article I want to share 7 ways with you. These are 7 ways you can increase your net worth this year.

- Our Net Worth Story

- Here Are 7 Ways to Grow Your Net Worth Today and Increase Your Net Worth This Year

- 1. Buy a House With a 15-year Mortgage

- 2. Invest In Your Jobs Retirement

- 3. Reduce Your Debt

- 4. Take Care of Your Health

- 5. Have An Emergency Fund

- 6. As Your Earnings Increase, Spend the Same

- 7. Focus On Your Net Worth

This blog post contains affiliate links that we trust. If you use these links to buy something we may earn a commission, at no cost to you. Read our full disclaimer policy here. Thanks

Our Net Worth Story

At 30 years old, my wife and I had a negative $30,000 net loss. We owned a $30,000 house that was worth about $30,000, and we owed $50,000 in student loans and $10,000 in consumer debt from cars, credit cards, and more.

In terms of assets, we had close to $30,000, and all of it was from my Missouri Teachers Retirement Fund.

Today, twenty years later, our net worth is just over $600,000, and growing steadily. In the next 5 years, our goal is to be at $1M, and we are on pace to get there. If we can do it, you can do it too!

Your net worth is not a measure of your worth to people, your worth to society, or a measure of your worth to your family and friends. Net worth simply applies to your monetary wealth, and is a matter of the basic formula: Assets – Liabilities = Net Worth.

Click here for a great net worth calculator from nerdwallet.com

Check out the video at the end of this blog post for the Average Net Worth by age 40

Here Are 7 Ways to Grow Your Net Worth Today and Increase Your Net Worth This Year

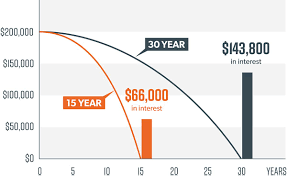

1. Buy a House With a 15-year Mortgage

If you aren’t in the market to buy a new home, consider refinancing your current mortgage to a 15-year mortgage. We purchased our home in 2005 and put in on a 30-year mortgage. From 2005 to 2014 the principle that we owe went down only $13,000 in those 9 years. In 2014 we refinanced our home on to a 15-year mortgage.

Because we went to a 15-year mortgage, from 2014 to 2021 the amount we owe went down $50,000 in 7 years. We gained more than 3 times the equity in the house in only two-thirds of the time. If we had originally had the home on a 15-year mortgage, the home would be paid off today.

However, admittedly, we weren’t smart for the first 9 years of the mortgage, and we are paying for that mistake now.

If you don’t do anything on this list, do this! In fact, if you want even more growth from real estate, buy a rental property or two to hold. Rental properties appreciate in value also, and they add to your net worth too. You will reap the benefits down the road, trust me. You can thank me later!

2. Invest In Your Jobs Retirement

At least invest up to the company match, if there is one. Whether it’s mutual funds, ETF’s, or Index funds, you need to be investing in the stock market. I’m not a fan of single stocks, unless you are a professional, but one way or the other, you need to be in the market.

Stock market participation is easiest if its automatic and you don’t see the money, so having it come directly out of your checks is perfect. Check out Where to Invest Your Money in 2021 for some ideas on what types of investments are out here and the risks involved with each one.

Also, keep in mind that the company match is “FREE MONEY”. Never leave free money on the table. Next to home ownership, participating in the stock market is by far one of the primary things that separate the haves from the have nots.

3. Reduce Your Debt

Everyone focuses on assets and ignores the liabilities side of the equation. If you want to really have a tremendous effect on your sanity, your peace and joy, and your liabilities side of the equation, then you need plan to pay off your debt.

Sell some things, cut up the credit cards, don’t accrue any new credit card debt, or decide to never get another car payment again in your life. Do what you have to do, but just don’t ignore your debt.

Debt and loans kill your net worth. Don’t fall into the trap that other peoples money (OPM) is your key to wealth. The key to your wealth is you.

You can’t rely on borrowing your way to wealth

Dave Ramsey

We’ve learned our lesson and we’ve been on a debt free journey for quite some time, and I’m glad to say that we are getting close. There will be a blog posts coming about our debt-free journey.

Click below to sign up to read about my biggest money mistake, get 5 Frugal Habits Anyone Can Do, and to get our latest blog post to your email.

4. Take Care of Your Health

What good is money if you are in poor health and can’t enjoy it. You net worth takes time to grow, and you get that time by taking care of yourself. Exercise, eat cleaner, walk regularly, get plenty of sleep, manage stress, and value your physical, mental and spiritual well-being.

Again, there are many ways you can increase your net worth this year, and your health is one that you can change this moment. If it means eating less, changing your grocery shopping habits, or utilizing the gym that you paid the membership for and never use, you’ve got to do something constructive about your health and your well-being.

Yes, your children and grandchildren will benefit from all of your monetary hard work, but it’s nice for you to be able to be here to enjoy some of it too!

5. Have An Emergency Fund

The more you have aside to manage emergencies, the less you ever have to slow down or stop your investing. Emergencies will happen. Ok, I hope you are getting this….I said “emergencies will happen”. That is automatic and there is absolutely nothing you can do about it, regardless of how hard you pray, how good you look, how much money you make, or how nice you are to other people.

Because emergencies happen to everyone, you have to be prepared. There is no way around it. If you aren’t prepared for an emergency, it will rock your foundation. If you are prepared to deal with an emergency from a net worth standpoint, then you will be rocked, but your foundation will remain intact.

People borrow from their 401(k) and get loans when there is an emergency. Don’t do it! Just start planning and saving now for the upcoming emergency, because it’s coming, and it can rob your assets side of the equation, or attack your liabilities like gangbusters, when it happens.

6. As Your Earnings Increase, Spend the Same

This is one of my favorite ways to increase your net worth this year. Keeping your expenses down sounds like an easy principle, but if it were that easy, everyone would be doing it. Normal inflation aside, most people tend to spend more when they get more.

If you manage this correctly, it would regularly give you more disposable income to invest with and increase the asset side of your net worth equation.

7. Focus On Your Net Worth

When considering the most effective ways to grow your net worth today and ways you can increase your net worth this year, focused intensity has to be a part of your plan.

People that have a lot of money, paid attention to the money.

Whether you are starting to increase your net worth in your 20s, building net worth in your thirties, or just getting ahold of your net worth in your 40s or 50’s, focus is the key.

For some of you reading this, you have a negative net worth (net loss). If you follow these 7 steps, and every 4 months, take the time to re-visit your net worth equation, with a net worth calculator, you will be surprised at the traction you get.

The bottom line:

Apply the energy and intense focus, put in the time and thought, and you will begin to see movement. These are 7 ways to grow your net worth today ways you can increase your net worth this year. When you first figure your net worth, you may be discouraged.

But there is no better time then now to change your situation, climb out of the hole, and make a difference.

Remember, whatever you focus on and give energy to, WILL GROW!!

Before you go, remember to Click Below to sign up for our latest blogs posts to be sent to your email.

Click below for the average net worth of a 40 year old

ABOUT THE AUTHOR

Eric is the founder of Smart Money Bro, a blog about empowering people and discussing practical ways ordinary people can be extraordinary with their money. He only writes about things that he has done, and that actually work. He’s made mistakes and has turned his financial future around, and is now in the position to help others do what he’s done. Read More