8 Millionaire Habits That Changed My Life

Millionaire habits are a game changer. While a big-time inheritance or a high six-figure job can certainly put money in your pocket and make you wealthy, it’s the little things, better known as “millionaire habits”, that tend to make the difference between a life of mediocrity and a life of prosperity.

Millionaire habits are things that wealthy people do on a regular basis that help determine their life. In this article I’m sharing 8 millionaire habits that I used to change my life.

- 1. Invested In My Jobs Retirement Plan

- 2. Focused Intensity On Net Worth

- 3. Made Debt a Bad Word

- Borrowing a bunch of money is not one of my millionaire habits.

- 4. Developed Additional Streams of Income

- 5. Volunteered to Help Others

- 6. Invested In Real Estate

- 7. Developed An Attitude of Self-Reliance

- 8. Invested In An Estate Plan

- BONUS to ADD to OUR LIST of MILLIONAIRE HABITS:

This blog post contains affiliate links that we trust. If you use these links to buy something we may earn a commission, at no cost to you. Read our full disclaimer policy here. Thanks

Here are the 8 millionaire habits that changed my life

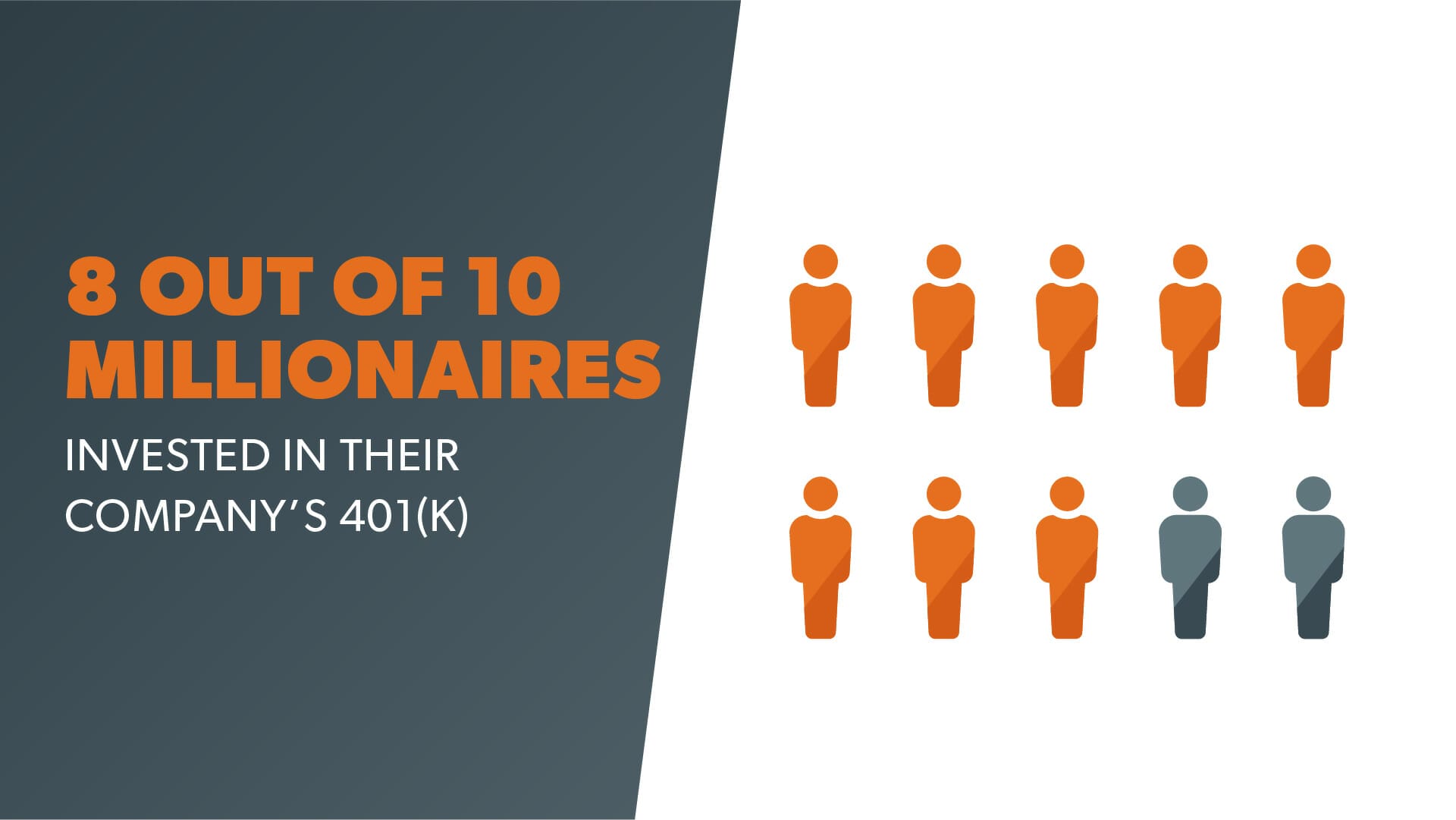

1. Invested In My Jobs Retirement Plan

I learned early on to not rely on the “get rich quick” method. The most reliable way to get rich is to strategize, plan, and invest in a methodical automatic way over a long period of time. It’s not fancy and it’s not sexy, but it works.

The 401(k), 403(b), or whatever your jobs retirement plan, is ideal for this. Don’t forget to take advantage of the free match (free money) that is offered. I can’t begin to explain to you how crucial this is.

2. Focused Intensity On Net Worth

This one took awhile for me to grasp. I stopped focusing so heavily on making more money and started focusing on keeping more money. I started focusing the little money I did have, on assets that appreciate in value and add to my net worth.

Check out the video at the end of this article on more millionaire habits.

On a blank piece of paper, put a line down the middle. On the left write down your assets, and their value, and on the right write down what you owe. The difference is either your net worth or net loss. This one quick exercise can really change your life.

Check out why your net worth really matters.

3. Made Debt a Bad Word

One thing that helped me more than anything was that I adopted a mentality that despised debt. I started living by the mantra that you can’t borrow your way to wealth. A house or a long term rental home with a large down payment, is ok, but anything else, buy it cash.

I don’t care what the “wealth gurus” tell you about “good debt” vs “bad debt”. I put all debt in a “bad” category. For the last 12 years, I haven’t borrowed money on anything. Credit cards have been a no no and our cars have been bought with cash.

If getting wealth were as simple as borrowing money, we’d all be rich!

Borrowing a bunch of money is not one of my millionaire habits.

One of the best ways to steer clear of debt is to spend less than you earn. This sounds simple and basic, but you’d be surprised how many people don’t follow this rule.

Are there uber-rich people that got through the use of borrowed money, sure. It does happen, but it’s not something I relied on.

4. Developed Additional Streams of Income

One of the best ways to develop a millionaire habit like the wealthy is to create ways to make money outside of your 9 to 5 job. After you have mastered the art of managing your money, it’s ok to look for ways to make additional income. Go for it!

I created ways to make money outside of my 9 to 5 job. After you have mastered the art of managing your money, it’s ok to look for ways to make additional income. Go for it!

There are ways to make money online everywhere you turn! If you are solely relying on a job for your income, you are taking a big gamble. Wealthy folks do take calculated risks, however, they usually don’t gamble. Click here for 16 smart money moves to make.

5. Volunteered to Help Others

Giving back is a small price to pay for the many blessings we have. Giving your time can lead to meeting new people and networking opportunities, that otherwise may not happen. It can open doors to learning opportunities too.

In my situation, I got involved with volunteering my time, my money, and my efforts. I joined the Planning Commission in my city, the Executive Board for another non-profit, and volunteered at my church, and other community based organizations.

6. Invested In Real Estate

Real estate is great to have in your portfolio, and is a proven way to build wealth. Real estate investing is a millionaire habit that shouldn’t be ignored.

In 2000, I began buying single family homes. I ended up losing a number of properties in the 2008 market crash, but I held on to two of them, and now have substantial equity in both of them.

7. Developed An Attitude of Self-Reliance

Many people need help and there is nothing wrong with that. However, many people rely too heavily on the notion that getting something for free is a good thing. Sure, it can help, but if you need government help or some form of charity, it should only be temporary.

I grew up in a family that, at one point, received government assistance and food subsidies, but we didn’t stay there. I also received food subsidies from the state government for 1 year in college, but, again, it was temporary and I didn’t stay there. I’m not against help for those who need it most, but it should be a last resort and shouldn’t last long.

When I developed an attitude that what I became in life was based on what I do, not someone else, my financial life grew stronger.

As long as you blame other people, then you give them the power to control and own your solutions to your financial problems.

Wealthy people live by the notion that they control their own financial destiny based on their own financial habits. That’s why people with wealth don’t blame others and are in the habit of holding themselves responsible and accountable. Once you get to this point, It’s a complete financial game changer!

8. Invested In An Estate Plan

This millionaire habit is all about securing your assets and leaving a legacy with your money. Besides giving you control over how your assets are to be distributed, estate plans also provide instructions on the care you want to receive if you become incapable of caring for yourself.

Millionaires think LONG TERM with their money. They think about preserving their assets and generational wealth.

BONUS to ADD to OUR LIST of MILLIONAIRE HABITS:

Save up and pay cash for your cars! This one could save you a ton of money over the course of your lifetime. I’m talking hundreds of thousands of dollars. Thankfully, we haven’t had a car payment in about 11 years and it’s been one of the best financial decisions we’ve ever made.

Here is our total list of 8 Millionaire Habits plus the bonus!

ABOUT THE AUTHOR

Eric is the founder of Smart Money Bro, a blog about empowering people and discussing practical ways ordinary people can be extraordinary with their money. He only writes about things that he has done, and that actually work. He’s made mistakes and has turned his financial future around, and is now in the position to help others do what he’s done.

Before you go, remember to Click Below to sign up for our latest blogs posts to be sent to your email