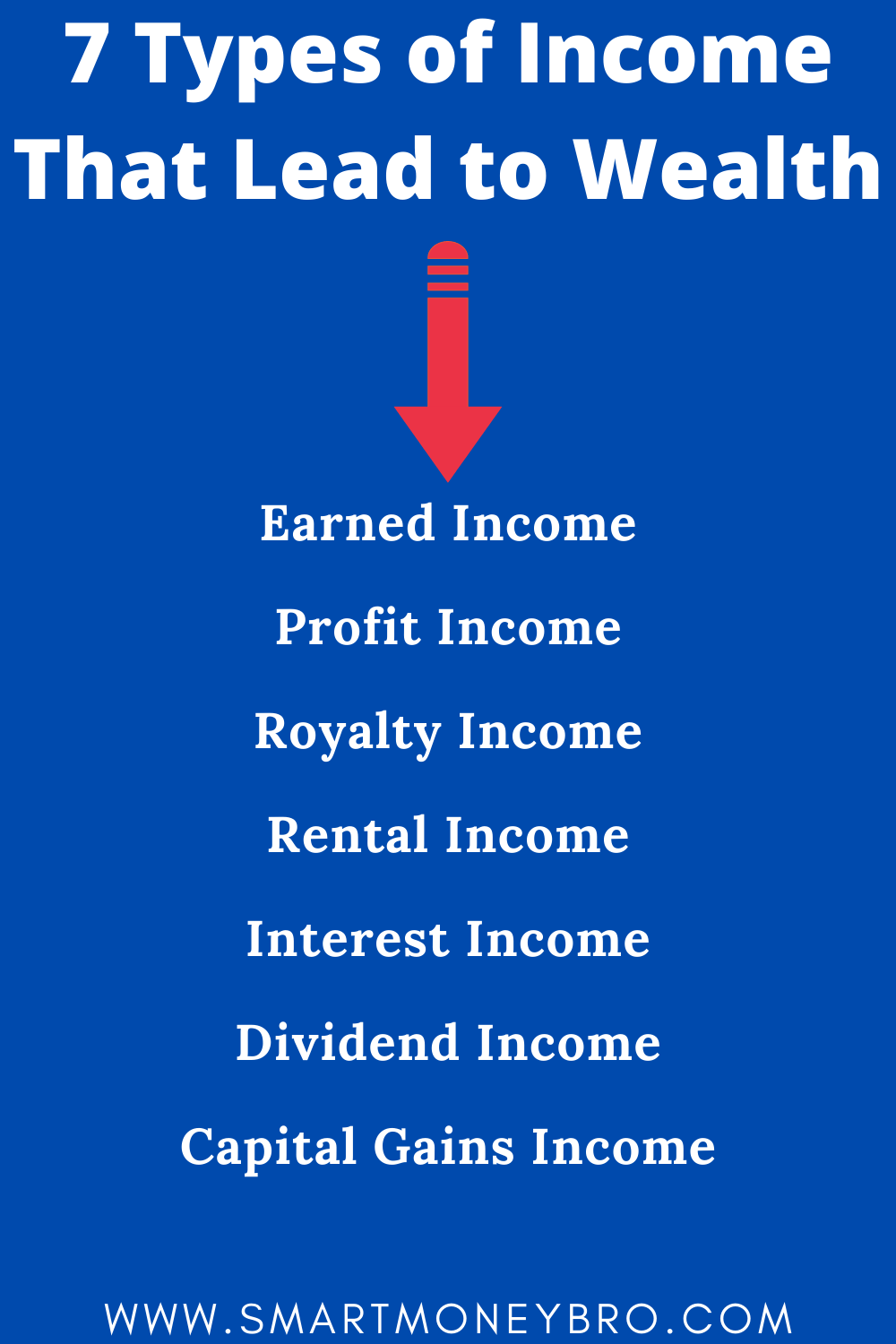

7 Types of Income That Lead to Wealth

If you understand and apply the information in this blog post, you CAN be wealthy. I almost never say that, but the information in this blog post is achievable by anyone.

If you want to achieve the goal of having monetary wealth, you should work towards having all 7 of these types of income as quickly as possible. As with anything, keep it simple with money and don’t overcomplicate things.

This blog post contains affiliate links that we trust. If you use these links to buy something we may earn a commission, at no cost to you. Read our full disclaimer policy here. Thanks

If you want to achieve the goal of having monetary wealth, you should work towards having all 7 of these types of income as quickly as possible.

For most of us, it may take 20 or 30 years, but for some of you, you can accomplish this much quicker, especially given the various ways to make money nowadays.

Check out the video near the end of this blog post to hear how I have diversified my income

The 7 Types of Income That Lead to Wealth

1. Earned Income

This is Income you receive from having a job, or self-employment. This is the highest taxed income. It includes the money you get from salaries, wages, bonuses, and tips.

With earned income you are trading your time and your efforts for money.

For a quick detailed explanation on earned income, click HERE.

2. Profit Income

This is income from buying something low and selling it at a higher price so that you earn a profit. It’s the revenue leftover after expenses.

You may hate to sell, but selling is how the world does business. Everyone is selling you something, perhaps it’s your turn.

3. Royalty Income

This is income from someone using your work. You could write a book on a topic you know well, about something you love, or simply something you have lots of experience with. Get paid royalties from it and you are in the ballgame. Royalties can also come from patents and trademarks.

4. Rental Income

This is income from owning, and then renting out the property, land, or equipment. Whatever the case, don’t sleep on this one.

It can be a home or commercial property, but I don’t care if its plumbing equipment, cookware, or a dump truck, this type of income is sweet. While you are considering rental income, do yourself a favor and buy-and-rent something that appreciates in value, so you can also take full advantage of the last item on this list!

5. Interest Income

This is income from lending your money to someone else to use. You can collect “simple interest” where you collect interest on the principal, or you could benefit from the amazing multiplying effect of “compound interest” where you collect interest on the principal and interest. Typically, this is done by investing in your jobs retirement account.

Interest income can also come from bank accounts, CDs, or loans to the government by purchasing T-bills. It is very important to do your research.

You can also lend money to individuals or businesses and collect interest. You get the point. There are many ways to benefit from interest income.

6. Dividend Income

This is income you get from owning stocks. Specifically, this is any distribution of a company’s earnings to shareholders from stocks you own. For some companies this is paid out quarterly, and you can always choose to reinvest this income back into the purchase of more company stock.

7. Capital Gains Income

This is income you get from the rise in value of an appreciating asset that gives it a higher value than the purchase price. Owning a home, a piece of land, a building, or any other type of investment property, will net you income from capital gains on the sale of that property.

This is why it’s important to always invest in assets that appreciate in value. That appreciation is money in your pocket! If you want to achieve the goal of having monetary wealth, you should work towards having all 7 of these types of income as quickly as possible.

Feel free to leave a comment and let us know what you are doing to achieve all 7 of these types of income.

ABOUT THE AUTHOR

Eric is the founder of Smart Money Bro, a blog about empowering people and discussing practical ways ordinary people can be extraordinary with their money. He only writes about things that he has done, and that actually work. He’s made mistakes and has turned his financial future around, and is now in the position to help others do what he’s done.

Before you go, remember to Click Below to sign up for our latest blogs posts to be sent to your email