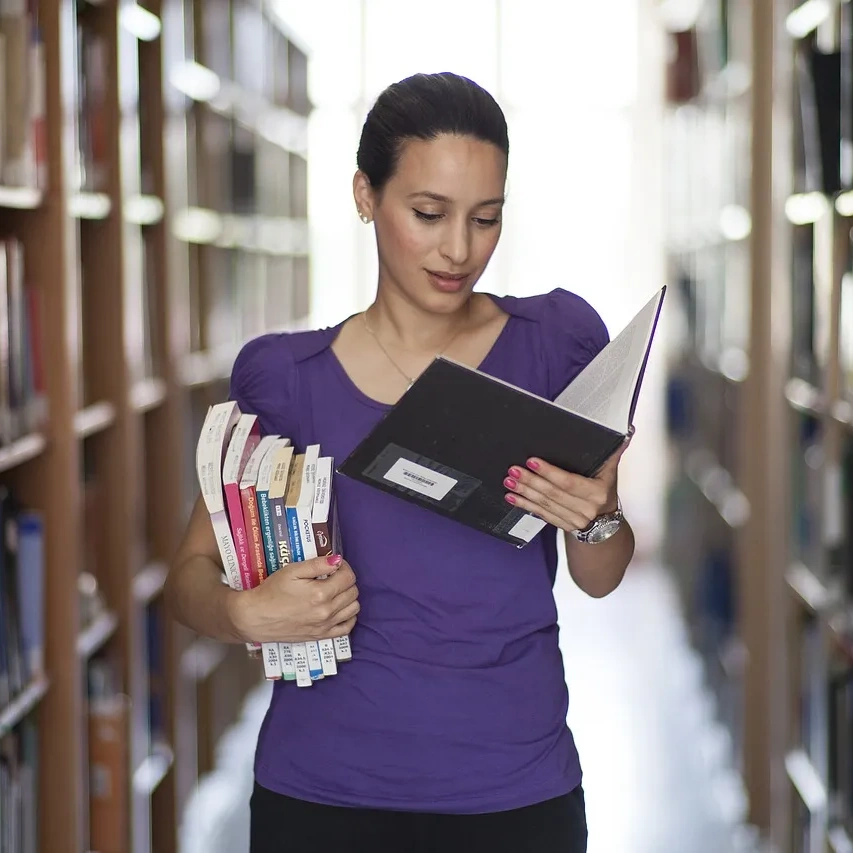

If you are looking for some good reading material to help you build wealth and win with money, this list of 5 books is a great place to start. These books come with my recommendation because I’ve read them as my own need to get better with my finances arose over the years.

I credit these 5 books with shaping my mindset about money and helping me get organized with my personal finances.

Here are my top picks for the 5 books to help you build wealth and win with money:

This blog post contains affiliate links that we trust. If you use these links to buy something we may earn a commission, at no cost to you. Read our full disclaimer policy here.