4 Things to Do Before You Invest

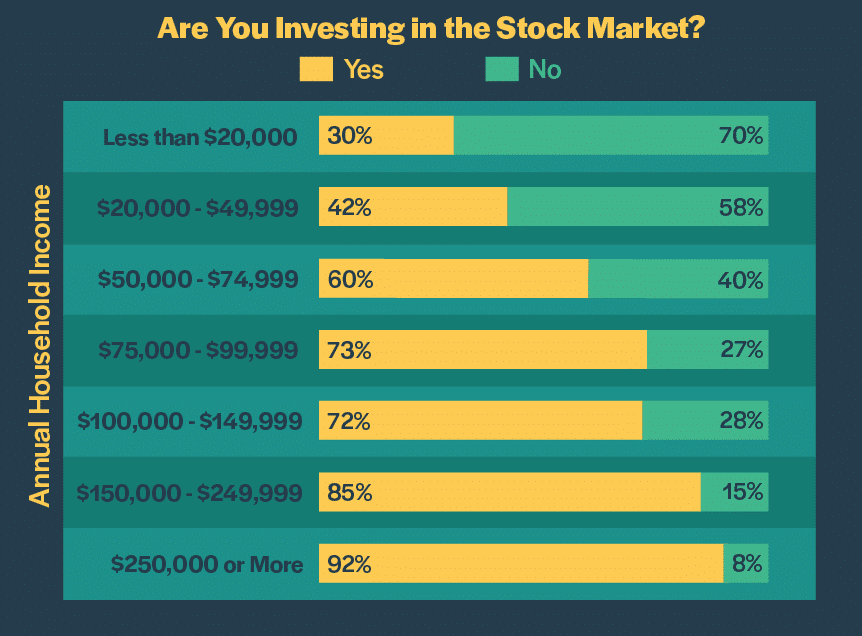

Investing your money as soon as possible is super important. The realty is, the older you get, the more money you make and the easier it is to invest your money. A recent report from Money Crashers found that people with higher incomes tend to invest more money in the stock market. Which is understandable.

This blog post contains affiliate links that we trust. If you use these links to buy something we may earn a commission, at no cost to you. Read our full disclaimer policy here. Thanks

The irony is that if you start early enough, you don’t need a lot of money to invest. By sacrificing early on you will reap some great benefits down the road. The key is to commit yourself to being just a little different than most people, when it comes to saving and investing.

With that said, when you do begin to invest, you want to hit the ground running. While investing your money as soon as possible is super important, waiting a month or two while you get all of your ducks in a row, won’t hurt you. In fact, it will likely help you in the long run. The trade-off is worth it.

It is better to start investing with the right mindset and the right tools, then to just jump right in and increase your chances of making costly mistakes.

Here are the 4 Things You Should Do Before You Start to Invest

1. Be Committed to Investing

Start with the right mindset that commits to the practice and the habit of investing. Do start and stop and start and stop again. Be determined to invest for the long haul.

How you think about money will dictate your behavior with money. So, do you look down on people that have money, or do you admire people that have money? Do you feel like you don’t need very much money, or do you want a lot of money?

2. Take Inventory of Your Current Financial Situation

The second thing you must do is take inventory of your current situation with your money. Figure your net worth by figuring what are your assets vs your liabilities? After that, figure your income vs your current expenses.

Do a budget for a couple of months so you have a better feel for your money. Write the budget down and start to be as disciplined as possible with your money. And whatever you do, start reading and researching smart money moves that you can start to make.

What about your job situation or your business situation? What are the ways you are currently making money to survive and potentially to thrive?

Are you maximizing your opportunities at your job, and through your other sources of income? Are you bringing in enough money to cover your expenses? Or said another way, are you lowering and managing your expenses in accordance with your income? Again, you are still taking inventory and reflecting here.

3. Develop a Debt Payoff Plan

Can you payoff debt and invest at the same time? The answer is yes. The intensity which you put towards each should depend on your age. How much time you have matters a lot when it comes to investing. Having $50,000 of debt at the age of 25 is a lot different than having $50,000 of debt at the age of 55.

Personal finances are personal. Therefore everyone’s situation is slightly different. In general, pay attention to debt. Regardless of your age or your situation, you need to pay attention to your debt and put a plan in place to attack it. Paying off debt frees up money to invest.

Remember this: If you have a Your $100,000 invested, but you have $100,000 in debt, your net worth is still 0. So, the one side of the equation a lot of people do not look at is their debts. You must develop a plan to lower your debts.

4. Visit Human Resources

At this point it’s time to make a visit to the human resources department at your job, or at the least do your research. I suggest starting with your jobs 401(k) or 403(b) plans. See what they offer, if they offer a match to your contributions, and learn as much about what they offer. If that is not available, start doing your investing research on your own to see what is out there.

A great place to start is with these 10 places to invest your money. Whatever the company match is, your plan should include contributing that amount. It’s free money! Whatever your choice is, get started and get informed. Never invest in something you don’t understand fully.

Take full advantage of your biggest wealth building tool, which is your income from your job, and do it automatically with automatic withdrawals from your paycheck.

If you are already doing this, perhaps you need to make some changes to your contribution amounts or even where the money is being allocated inside the retirement plan. Ask questions so that you feel comfortable.

If you change jobs, be sure never to cash out your money that you have stored in your job’s retirement plan. You will pay penalties. Be sure to have the money transferred to your new employer’s retirement plan.

We live in a day and age where everyone wants to start jumping out and investing, but you have to take care of the basics before jumping in with both feet. Remember, investing your money as soon as possible is super important. So you want to prepare and move quickly quickly so that you can start reaping the benefits of investing.

ABOUT THE AUTHOR

Eric is the founder of Smart Money Bro, a blog about empowering people and discussing practical ways ordinary people can be extraordinary with their money. He only writes about things that he has done, and that actually work. He’s made mistakes and has turned his financial future around, and is now in the position to help others do what he’s done.

Before you go, remember to Click Below to sign up for our latest blogs posts to be sent to your email